Fact vs. fiction: Don't buy the lies your PBM tells you.

Employers have been led to believe that their pharmacy benefit manager(PBM) is working in their best interest, but the truth is, that’s not always the case. The big three PBMs have spun a narrative that their approach to managing pharmacy benefits is the best (and only) way. In reality, many major PBMs exploit stagnation and factors they claim are out of their control in the industry to inflate their profits at the employer's expense.

Rightway applies a fundamentally different approach to pharmacy benefits management. Unlike other PBMs, we align our incentives with the goals of employers: low total pharmacy spending with high employee satisfaction. Our transparent PBM model ensures that every prescription reaches its lowest net cost, while our pharmacy navigation team directs members to high-value therapies and low-cost channels. This approach improves the drug mix and dispensing cost, two major drivers of overall prescription spending, while providing the exceptional member service Rightway is known for.

Uncover the truth behind the six biggest lies of traditional PBMs so you can make informed decisions for your team.

Fiction: PBMs charge employers fair prices for prescriptions.

Fact: Traditional PBMs use the following tactics to prioritize their own profits over savings for their clients.

- Spread pricing: PBMs use spread pricing to charge employers more for drugs than they pay pharmacies. The difference, known as the "spread," is kept as profit by the PBM. This practice is typically hidden from employers, leading to overpayments. While the spread may be small per drug, these spreads can result in substantial unnecessary costs for employers over time and across thousands of prescriptions. For example, a PBM might pay a pharmacy $50 for a drug but charge the employer $75, pocketing the $25 difference each month. In one year, the PBM profits an additional $300 on one member's prescription.

- Rebate retention: PBMs negotiate rebates and discounts with manufacturers based on the volume of drugs they manage. However, they often do not pass the full extent of these savings to employers. Instead, they pocket a portion of these rebates, further increasing their profits at the expense of employers. Even if your PBM contract promises to pass through 100% of collected rebates, their definition of rebates might still allow them to keep some of your rebate money.

Unlike traditional PBMs, Rightway does not retain any rebates or practice spread pricing. Rightway passes back 100% of savings, discounts, and all dollars received by pharmaceutical manufacturers to plan sponsors to truly reduce costs.

Fiction: PBMs design formularies based on which drugs have the best clinical outcomes for patients.

Fact: Traditional PBMs design their formularies to maximize profits. When building their formularies, PBMs prioritize drugs with larger rebates instead of drugs that are the most clinically effective or affordable. In fact, a recent study shows that more than half(57%) of the formulary exclusions for a big 3 PBM had questionable economic or medical benefits, or both, for patients. The focus on rebates means PBMs limit access to drugs that may be the most effective and affordable options for members.

Rightway’s performance formulary prioritizes high-value medications. Our pharmacy and therapeutics committee uses evidence-based literature and guidelines to make formulary recommendations so members have access to the most effective, cost-efficient therapies. Because Rightway does not retain any rebates, it has no incentive to give preferential placement to drugs with higher rebates on the formulary.

Fiction: PBMs lower costs by owning large parts of the pharmacy supply chain.

Fact: PBMs that own the supply chain profit from every drug dispensed through their own channels. This creates a conflict of interest because PBMs will steer patients to their owned channels, not the most cost-effective or efficient options for the patient, significantly driving up costs. Two major channels PBMs own are:

- Specialty pharmacies: PBMs that own specialty pharmacies often classify drugs as high-cost specialty medications, even when they aren't. The big three PBMs frequently have inconsistent classifications, with up to 54% of drugs on their specialty lists being generics—medications that are typically off-patent and should be cheaper due to competition. This allows PBMs to direct members to their own specialty pharmacies for more revenue.

- Retail and mail-order pharmacies: PBMs that own their own retail and mail-order pharmacies often steer members to their owned pharmacies, even when more affordable options are available. Further, they restrict access to outside pharmacies with tactics like preventing patients from receiving 90-day supplies if they fill prescriptions at a different pharmacy.

Rightway doesn’t own any parts of the supply chain. We have no incentive to superfluously classify medications as specialty or drive members to expensive, owned pharmacies. Instead, Rightway provides access to more options and savings through a wide network of pharmacies, like Mark Cuban Cost Plus Drugs, ensuring members get the best prices.

Fiction: Employers should only look at the costs of each individual medication to see if their PBM is saving them money.

Fact: Looking only at the price per pill of each medication doesn’t show the full picture. Utilization is a key driver of pharmacy spend. Even if the cost of individual pills is going down, total pharmacy costs can skyrocket if the use of medication increases. For example, costly medications like GLP-1s can significantly drive up total pharmacy spending each year if utilization is high. PBMs don’t manage the utilization of high-cost medication by:

- Having lenient medication approval rates. PBMs incentivized by volume have lower controls around prior authorizations. They are more likely to approve a medication that is not clinically necessary in order to collect profits.

- Mismanaging the drug mix. When a formulary includes a wide range of high-cost drugs without more cost-effective alternatives, it drives up the use of expensive medications.

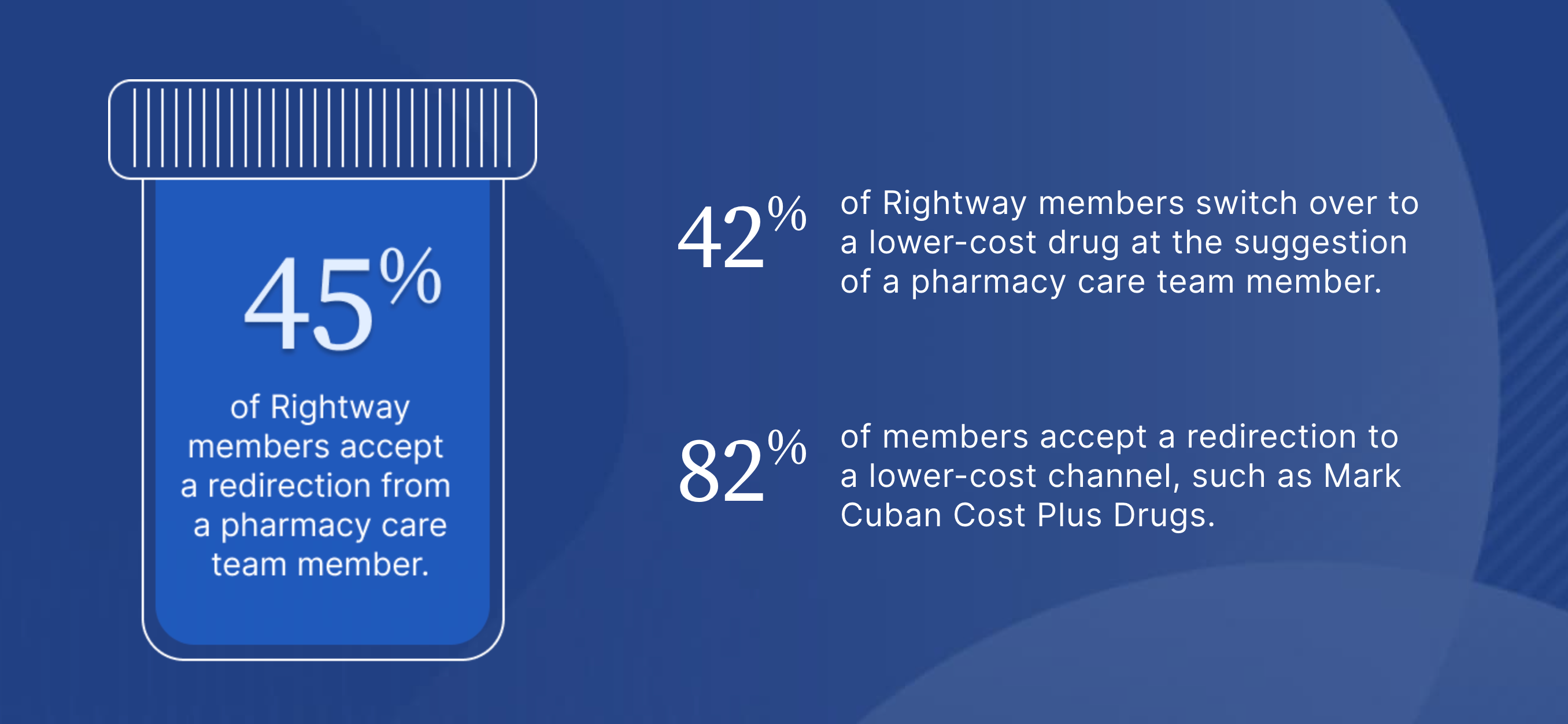

Rightway drives pharmacy savings by focusing on both the cost per pill and drug utilization. Our prior authorization process evaluates medications based on accepted treatment guidelines, not their revenue potential. Instead of issuing denials, our pharmacy navigation team assists in redirecting members to more appropriate options, managing the entire process on their behalf. This approach is highly effective, resulting in 82% of Rightway members accepting a redirection to a lower-cost channel and 42% switching to a lower-cost drug. By taking on the legwork for members, we ensure member satisfaction, evidenced by an NPS score of +70, while significantly lowering overall costs.

Fiction: PBM pricing and contract terms are transparent.

Fact: PBMs use opaque contracts to make it impossible for employers to trace pharmacy benefit spending. Contracts frequently omit crucial information about revenues from spread pricing and rebate retention, hiding the PBM's financial manipulation. Many contracts also limit or prevent plan sponsors from auditing their PBM, making it challenging to understand the actual price they are paying for prescriptions and to identify and address discrepancies or overcharges. This convoluted contracting obscures whether the PBM is delivering promised savings and allows PBMs to manipulate financial data and mask cost increases.

Rightway removes uncertainty with a thorough and transparent PBM contract. Revenue comes from a fully disclosed administrative fee, and we offer employers extensive audit access. Rightway provides robust reporting, helping employers make informed decisions about their pharmacy benefits. With our straightforward contract and comprehensive reporting, it's easy to see that we deliver on our guarantees.

Fiction: PBMs are not responsible for rising drug costs.

Fact: PBMs actually have significant control over total drug spending. They control the price of medications, which drugs members take, and how they access them. However, when a PBM is primarily focused on its own profits, it uses that control to drive costs up, not down. PBMs determine the formulary and often prioritize higher-cost drug options even when cheaper versions exist. They also limit pharmacy choices, preferring their own specialty and mail-order services instead of helping members find the best price.

Rightway designed a PBM that is aligned with its employers and uses every tactic to lower pharmacy spending for them and their teams. From the design of the formulary, to the avoidance of games and gimmicks and the complete refusal to forego conflicts of interest by owning parts of the supply chain, Rightway is the leader among innovator PBMs bucking the shady big 3 playbook.

As the only PBM with embedded pharmacy navigation, Rightway effectively guides members to affordable medications, directs them to lower-cost pharmacies, and utilizes financial assistance programs for maximum savings. This comprehensive approach engages members, makes them feel cared for, and transforms them into better pharmacy consumers.

Don’t be misled by traditional PBMs. It's time to take control of your pharmacy benefits and choose a transparent PBM that will work with you to reach your goals. Rightway’s transformational pharmacy benefits management helps employers benefit their teams and their bottom line. Read our latest annual report to see how we're redefining pharmacy benefits and cutting pharmacy spending for innovative employers.