What is a drug formulary? Tiers, costs, and how it works.

What is a Formulary?

A formulary is a list of prescription drugs that a health insurance plan or pharmacy benefit manager (PBM) will cover for its members. In simple terms, it’s the plan’s approved drug list (sometimes called a preferred drug list). A formulary serves as a guide by outlining which medications are preferred and covered, and helps manage medication costs while ensuring patients have access to safe and effective treatments.

By understanding how formularies work, employers can make more informed decisions when evaluating their pharmacy benefit plans. Formulary design is one of the most powerful tools employers and PBMs have to align pharmacy strategy with broader organizational goals—whether that means reducing healthcare spend, improving access to certain medications like GLP-1s, or improving employee health outcomes.

How drug formularies work.

Behind every formulary is a rigorous, evidence-driven process. Most health plans lean on an independent Pharmacy & Therapeutics (P&T) committee, a panel of physicians, pharmacists, and other clinical experts, whose job is to decide what makes the cut. They weigh a medication’s clinical effectiveness, safety profile, and real-world value. When two drugs treat the same condition equally well, the committee will favor the option that delivers similar outcomes at a lower cost. The goal is simple: keep the formulary stocked with safe, proven therapies that maximize health outcomes and minimize unnecessary spend.

PBMs then layer on the financial side of the equation, negotiating rebates and discounts with manufacturers. Drugs that strike the best balance of quality and affordability earn “preferred” placement, lower tiers, fewer restrictions, and lower member cost share. This clinical-plus-financial filter is how formularies stay aligned with both patient care and an employer’s budget.

But a formulary is never a set-it-and-forget-it document. P&T committees meet regularly to review new FDA approvals, fresh clinical data, and updated treatment guidelines. If a study shows a drug is safer or more effective than current options, the list changes. If a brand drug loses patent protection and a lower-cost generic or biosimilar hits the market, tiers shift. PBMs also re-negotiate contracts and rebates, swapping in more cost-effective choices whenever possible.

The result? A living, breathing formulary that’s continuously refined to stay clinically relevant and cost-smart so employers can be confident their pharmacy benefit is delivering value today and tomorrow.

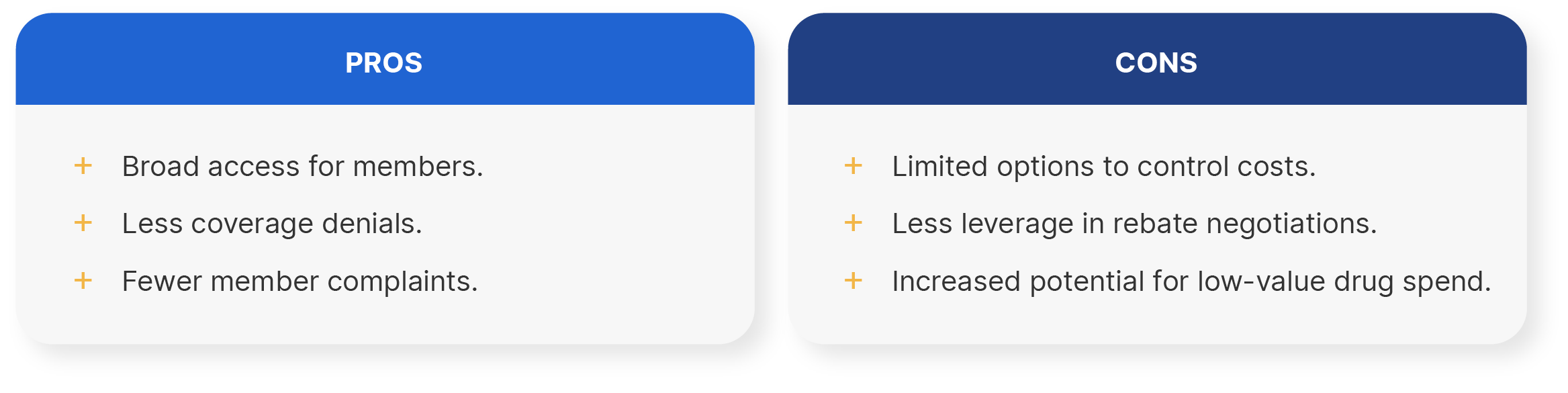

Open formularies.

An open formulary provides coverage for a very broad range of prescription medications with few, if any, drugs excluded from coverage. This means patients and their doctors have greater flexibility as virtually all prescription drugs are on the menu, and even higher-cost brand or specialty drugs will be covered by the plan at some level.

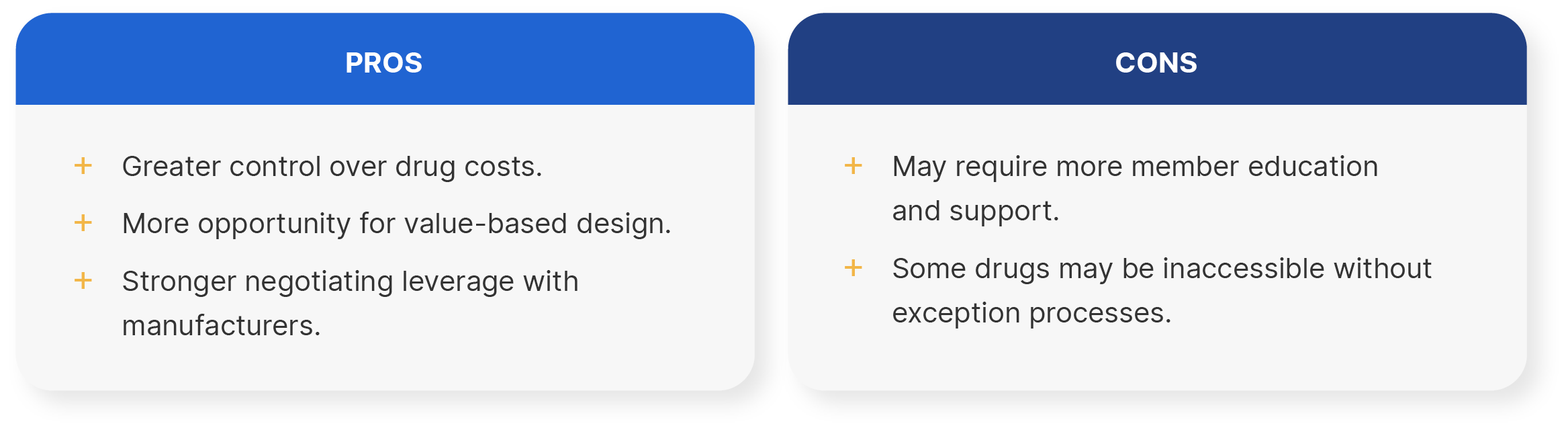

Closed formularies.

A closed formulary limits coverage to a specific list of approved drugs. Medications not on the formulary are generally not covered by the plan, so the insurer won’t pay for them. If a physician prescribes a non-formulary drug the member would have to either pay the full price out-of-pocket or use a covered alternative.

Understanding formulary tiers.

Formulary tiers are a way for pharmacy benefit managers (PBMs) and health plans to group medications based on their cost and clinical effectiveness. Each tier represents a different level of coverage and member cost-sharing, with lower tiers typically offering lower-cost or preferred medications and higher tiers including specialty or non-preferred drugs with higher out-of-pocket costs.

The purpose of tiering is to help manage pharmacy spend by incentivizing the use of cost-effective, clinically proven treatments while ensuring patients have access to the medications they need. This tiered structure allows plan sponsors to control costs without compromising care quality by guiding prescribing and utilization behavior. Tiers can vary by plan, but they generally look like the following:

- Tier 1: Generic medications, which include low-cost, clinically effective generics typically used as first-line treatments.

- Tier 2: Preferred brand-name drugs and non-preferred generics, typically higher-cost generics or lower-cost brand-name medications.

- Tier 3: Non-preferred brand-name drugs and some specialty drugs, usually brand medications with less favorable pricing or those with alternative therapeutic options available.

- Tier 4-5: Specialty medications, including high-cost treatments such as biologics or therapies that require special handling or administration.

Where to find a plan’s drug formulary.

One of the most common questions employees ask about their pharmacy benefits is, “How do I know if my medication is covered?” It all comes down to understanding and accessing their plan’s drug formulary. Most health plans make their formularies available through online member portals, which can typically be accessed after logging into the health plan’s website.

What happens if a drug is not in a formulary?

Not all medications are included in a health plan’s formulary, and this is referred to as a non-formulary drug. A drug may be left off the formulary if it offers limited clinical value compared to alternatives, carries a significantly higher cost without added therapeutic benefit, or lacks favorable pricing and rebate terms negotiated with the manufacturer. When a prescribed drug isn’t on the formulary, health plans typically offer two options:

- A covered alternative. The provider can prescribe a similar, covered medication from the formulary

- Request for a formulary exception. The provider can submit a request for a formulary exception.

Formulary management strategies for PBMs.

Across the PBM industry, formulary management strategies are used to balance clinical effectiveness with cost control.

At Rightway, we believe that formulary design should prioritize clinical value over rebate maximization, a key departure from the legacy PBM model. Traditional PBMs often favor high-rebate drugs that may increase the total cost of care and complicate access. In contrast, our approach emphasizes evidence-based prescribing, transparent pricing, and alignment with client outcomes. We use utilization management policies to safeguard member health, not to drive rebate-driven preferences. This shift allows us to deliver a pharmacy benefit that is not only more affordable but also clinically sound, accessible, and aligned with the needs of employers and their members.

Rightway helps PBMs optimize formularies and reduce costs.

Pharmacy benefit managers (PBMs) play a critical role in managing formularies to balance clinical efficacy, member access, and cost control. How they do it has a direct impact on both pharmacy spend and employees' health. Unfortunately, most traditional PBMs structure formularies to maximize rebates and revenue, not to achieve the lowest net cost or best outcomes.

Rightway takes a different approach. As a fiduciary-aligned PBM, we prioritize clinical integrity and cost-effectiveness. Our P&T committee is fully independent and guided by evidence-based criteria, not rebate contracts. No rebate traps. No spread pricing. The result is a smarter, more sustainable formulary strategy that supports better care and delivers meaningful savings. Just smarter, evidence-based decision-making that keeps your plan fiduciary aligned and your members supported.

Learn more about Rightway’s offerings.